The Business Energy Monitor captures data on how New Zealand Businesses understand and use energy, both as a snapshot and how this develops over time. Alongside broader behavioural and attitudinal trends, this ongoing research allows EECA to give evidence to help shape its programmes and understand the impact of its interventions.

Overview

This is the second edition of our refreshed business monitor. The purpose of this business monitor is to better understand New Zealand businesses’ relationship with energy.

Between 11 to 26 November 2024, and again between 20 to 30 May 2025, EECA surveyed a representative sample of the New Zealand business market based on size (FTE), and industry. In total 1,351 decision makers responsible for personnel, vehicle or energy decisions took part in this survey.

Key findings

This research did a deep dive into how well businesses understand, manage, and conserve their energy use, as well as their acceptance and adoption of energy-efficient products and practices. It found that most businesses prioritise financial performance over sustainability, with around half yet to implement any energy-saving actions or assess their sustainability efforts.

There are a small group of business leaders progressing energy efficiency but operational context such as size, site ownership, and vehicle use, significantly shape the ability to take energy-efficient action. Knowing where to find guidance and resources is a major driver of progress, separating businesses that are advancing from those that are stalled. Smaller, home-based, and renting businesses face the greatest barriers, underscoring the need for more tailored and accessible support.

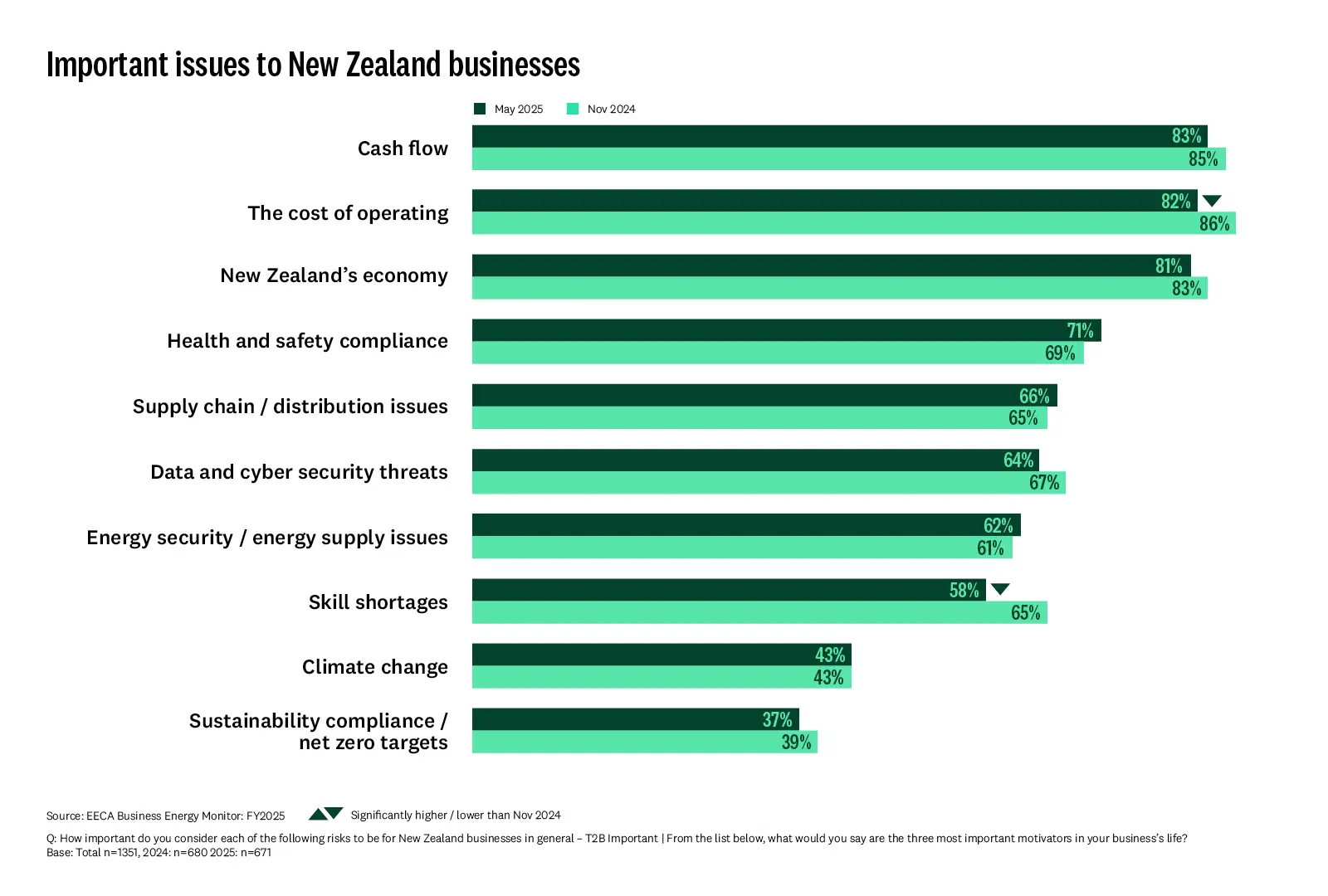

Businesses value energy security, yet higher priorities remain

Three in five businesses consider energy security an important issue. Issues related to cashflow, operating costs, and the broader economy remain the dominant concern, despite softening slightly. The importance of energy security is more evident among businesses that use high amounts of energy for refrigeration (68%), lighting (66%), and commercial water heating or cooling (71%). It is also a heightened concern for businesses that own their premises (66%) and those operating large vehicles (65%).

Half of businesses monitor energy use, with higher rates among vehicle users and infrastructure-intensive industries

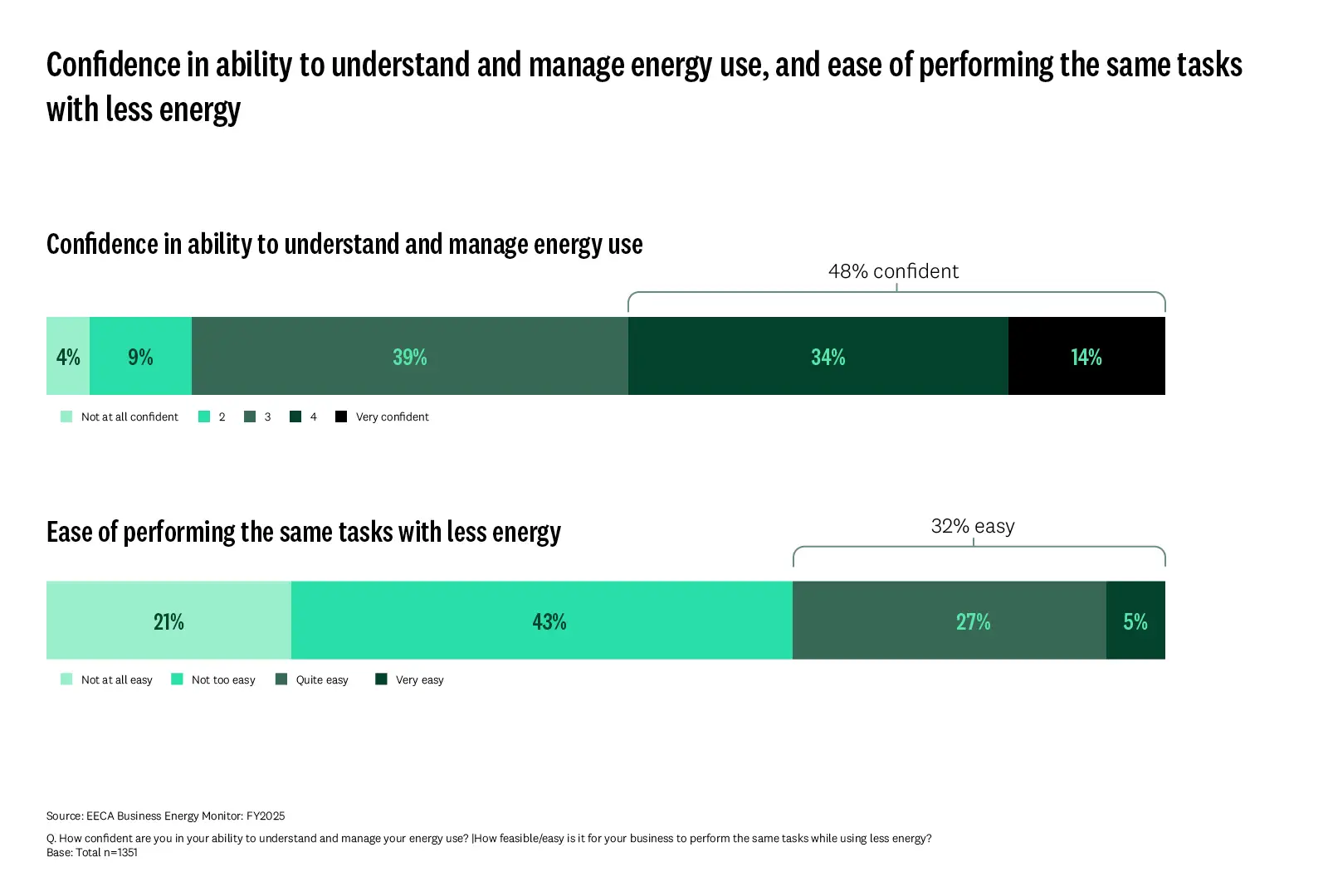

Many businesses are uncertain about how well they understand and manage their energy use, and some doubt their ability to do the same tasks with less energy. Overall, fewer than one in five feel very confident in their ability to manage their energy consumption. Confidence drops even further when it comes to efficiency with only around one in twenty saying it is very easy to perform the same tasks using less energy.

Knowing where to find information boosts businesses’ energy management confidence

Knowing where to find information on improving efficiency correlates with businesses feeling it is easier to perform the same tasks using less energy. Combined with their confidence levels, this shows that access to the right information plays a key role in enabling businesses to make meaningful changes.

Despite some action overall, many businesses remain behind on setting targets and monitoring energy use

Businesses that have accessed information in the past three months are more likely to be taking steps toward energy efficiency, such as tracking their energy use and developing energy reduction targets. Awareness of EECA also plays a strong role. Those who have heard of EECA are significantly more likely to monitor and track their energy use on an ongoing basis (62%) and are far more likely to be in the implementation or development stages of setting energy reduction targets (58% and 59%, respectively).

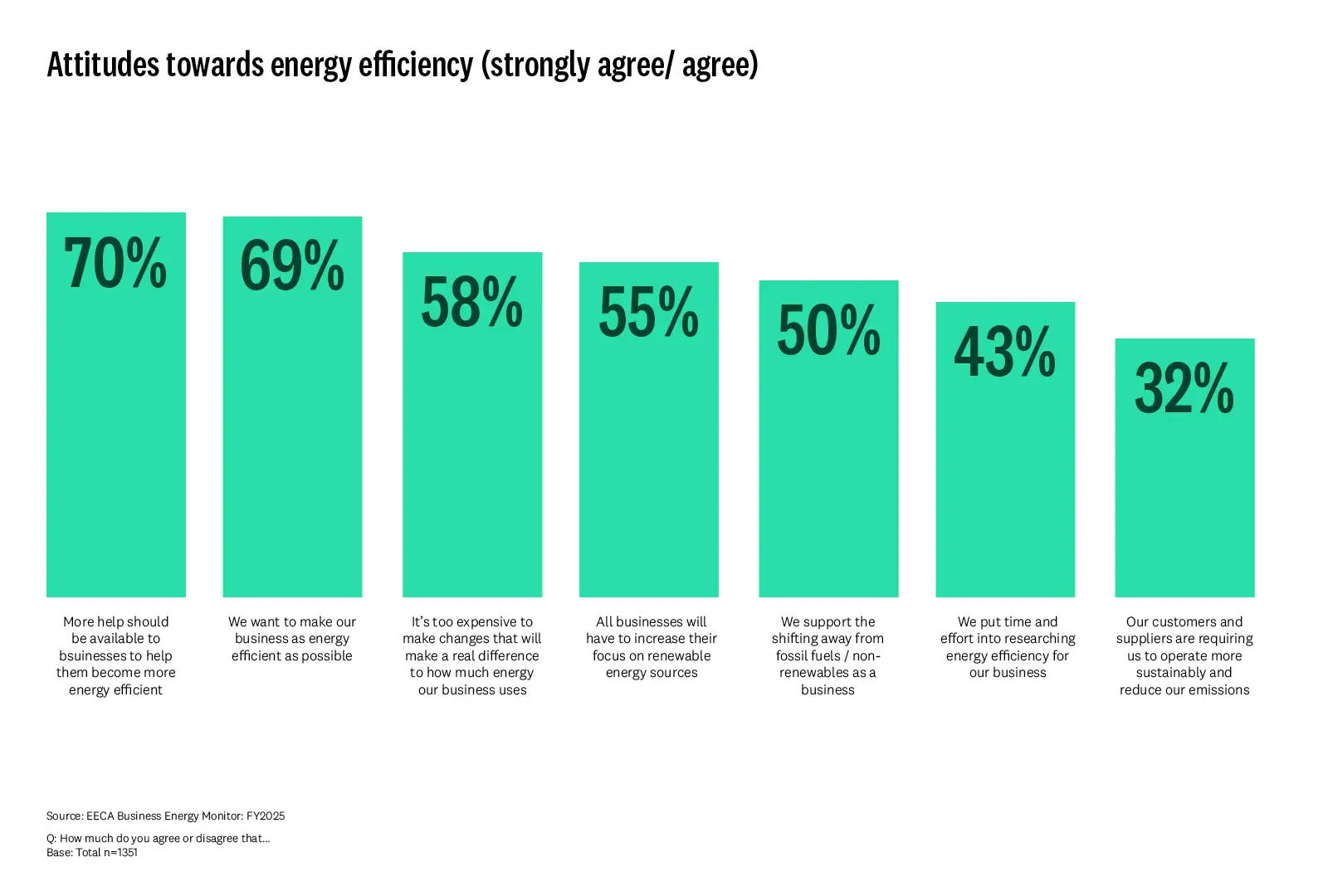

Businesses want to be more energy efficient, and need more help to get there

Over half of businesses (58%) believe meaningful energy-saving changes are too expensive. Only half support moving away from fossil fuels, indicating continued hesitancy around renewables. This concern about cost is strongest in the electricity, gas, water, waste, and construction sectors. Awareness of low-cost energy-saving actions is modest, with turning off lights and regular maintenance the most widely known and adopted measures. However, significant gaps remain between awareness and action, particularly for optimising system settings and measuring energy use, with around one in ten businesses unaware these steps could improve efficiency.

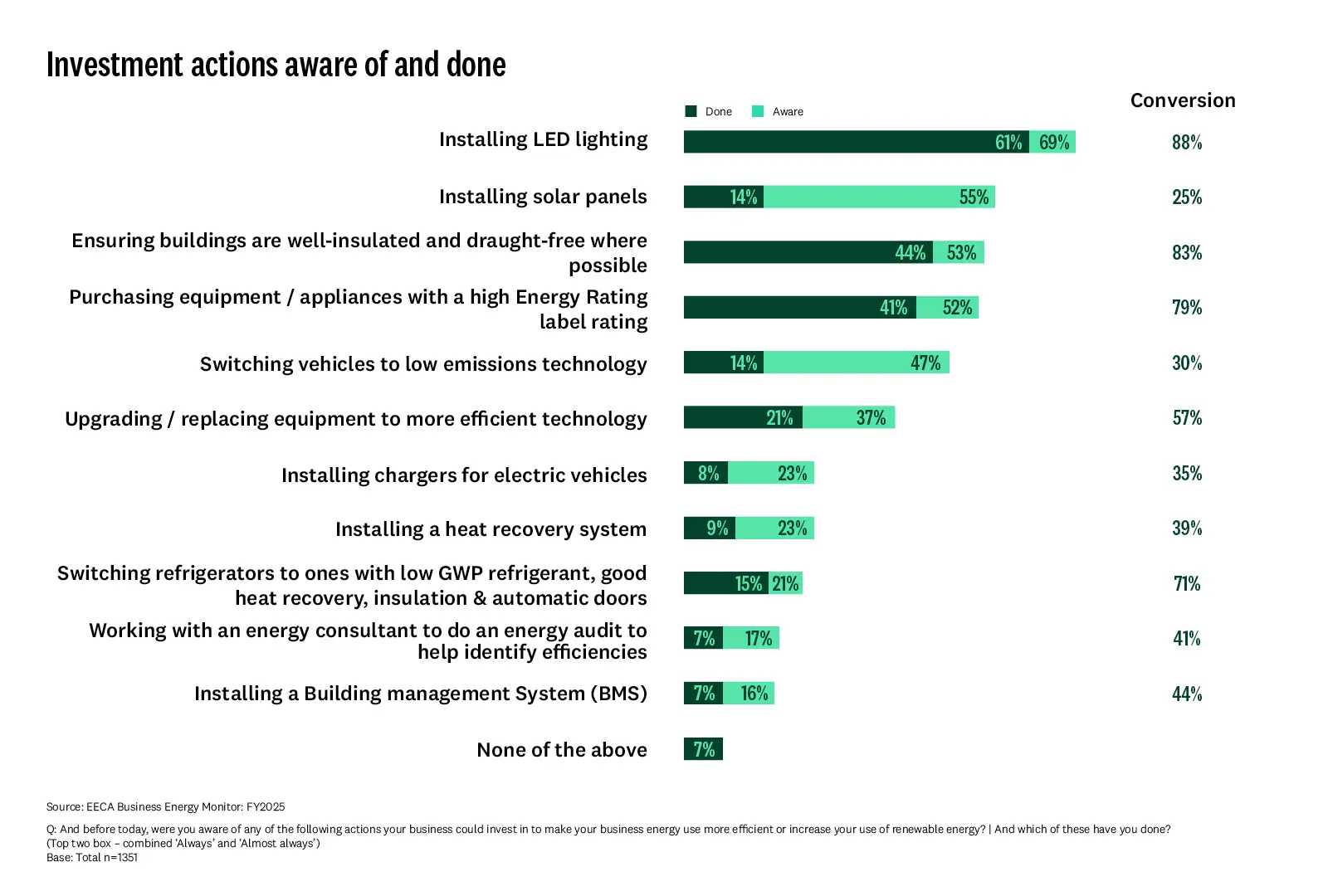

Businesses know what major upgrades are needed, but many aren’t taking action

Businesses with high energy use in heating, ventilation and air conditioning (61%), transport (59%), and lighting (56%) are more likely to be aware of energy-efficient equipment. However, awareness of larger, more costly upgrades often does not translate into action. Premises owners and home-based businesses are more likely than renters to know about, and complete, improvements like insulation and solar panels.

Transport-intensive businesses turn awareness into action

These businesses are more likely to promote reduced car use (43% aware, 34% acting) and optimise driving routes (48% aware, 47% acting). Similar patterns appear among users of cars, light commercial vehicles, and trucks over 5.9 tonnes.

Businesses that rely on cars for daily operations also show higher awareness and uptake of switching to low-emission vehicles (50% aware, 21% acting) and installing electric chargers (27% aware, 13% acting). Importantly, over half of businesses that do not currently use electric vehicles plan to electrify part of their fleet within the next five years, signalling growing readiness to transition.

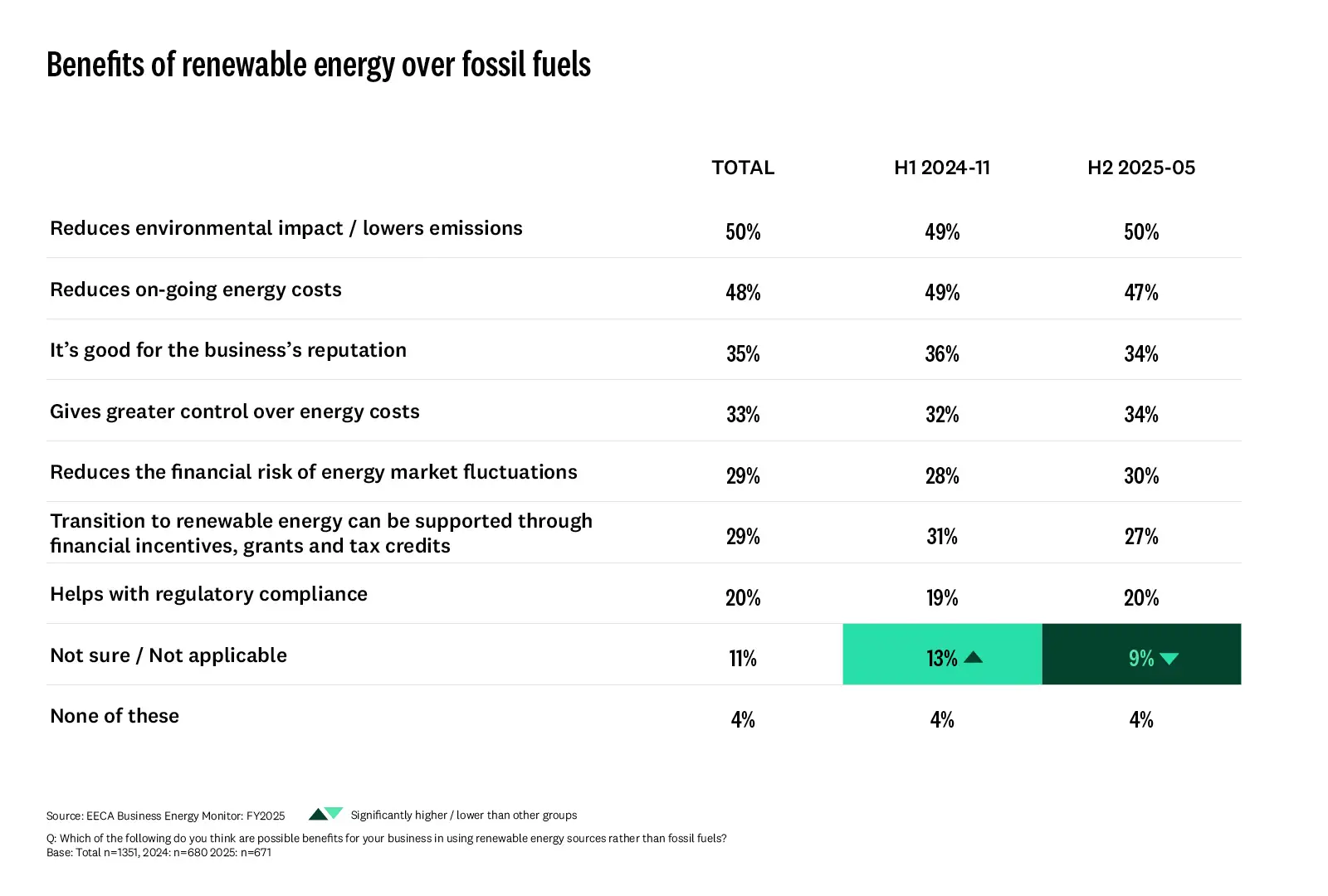

Businesses increasingly view environmental benefits over cost savings as the key advantage of renewables

Concerns about the high upfront costs of renewable energy have eased, but businesses are increasingly worried about resistance from stakeholders. Drawbacks differ by technology: those exploring solar remain concerned about upfront costs (52%), while those looking into renewable gas are more likely to cite lower energy output (40%) and stakeholder opposition (40%).

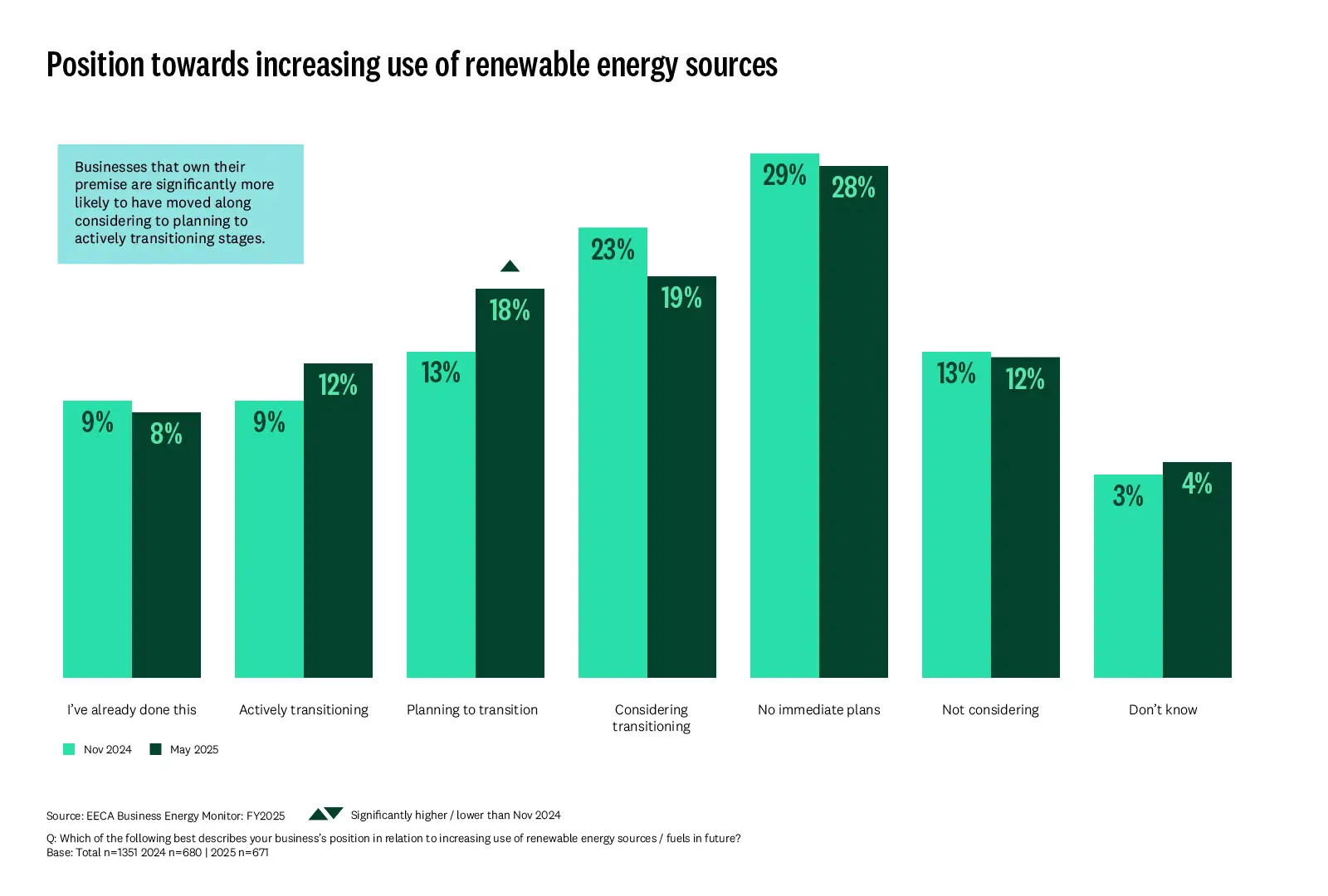

Renewable transition plans rise, with one in five businesses preparing to shift

Administrative and finance businesses are ahead of industries like agriculture and forestry. Interest also differs by energy type: grid-supplied renewable electricity is most often investigated by electricity, gas, water, waste, and construction businesses (60%), e-fuels and green hydrogen by transport and warehousing (35%), and scientific services are notably more likely to have already invested (57%). Premises owners show strong engagement, with 55% having explored solar, and larger businesses (20+ FTEs) are more likely to look at multiple renewable options.

Overall, the research shows that while businesses are increasingly interested in energy efficiency and renewables, progress is held back by cost concerns, low confidence, and gaps between awareness and action. While more businesses plan to transition to renewable energy and electrify their fleets, financial pressures and stakeholder resistance mean progress remains uneven across sectors.