EECA commissioned a detailed report to explore how electricity is being used at different times of day, how much of that electricity use could be shifted from busy times to quiet ones, and how much it would cost to incentivise electricity users to be flexible.

About the research

EECA’s research aims to understand how much potential there is to shift when New Zealand households, business and industry use electricity, and what it would cost to unlock that potential.

The report, delivered by independent consultancy Jacobs, contains data analysis, stakeholder surveys and modelling.

It found that up to 1,800MW (megawatts) of demand across New Zealand, enough to lower electricity use at the busiest times by up to 25%, could be shifted away from peak times, without impacting lifestyles or business productivity.

On this page

About flexible electricity use

Busy times of high demand (such as winter evenings) play an outsized role in driving power bills up, because power poles and wires and electricity generation are built to cater for relatively short demand peaks.

Being flexible about when we use electricity (sometimes called ‘demand flexibility’) refers to residential, commercial and industrial consumers of electricity changing when they use electricity in response to signals from the electricity market. It typically involves shifting load to:

- smooth peaks by avoiding consumption during times when the electricity grid is congested or generation resources are stretched

- fill valleys in the use of the electricity system by shifting more consumption to quieter periods or times when there is more electricity available.

This can be done manually or with the help of technology like batteries or smart energy management systems. These can operate home appliances automatically without compromising home heating, hot water, or EV charging — ideally without users even noticing.

Flexibility can be a way to put more control in the hands of electricity users by giving them an option to lower their bills, while also contributing to a secure and affordable energy system.

Research objectives

As New Zealand’s energy system evolves, understanding and harnessing the power of flexibility is becoming increasingly important.

This study provides a detailed assessment of the current landscape, full potential, and pathways for unlocking flexibility across various sectors of the New Zealand economy.

The main objectives of the research were to:

- Evaluate the current state of flexible electricity use in New Zealand through a literature review and stakeholder engagement, including carrying out surveys of electricity lines companies and major electricity users.

- Quantify the potential for flexibility across different sectors and regions by forecasting different scenarios for electricity demand.

- Identify barriers and enablers.

- Develop recommendations for unlocking the full potential.

To do this, the research team combined data analysis, modelling, and stakeholder input and adapted international best practice to suit the unique characteristics of New Zealand’s electricity system.

A unique dataset was created comprising electricity use at 30-minute intervals, broken down by region, sector and end-use. This dataset was then used as the input source for a modelling tool developed to quantify and optimise flexibility.

Key findings

- Between 1,700 and 1,900 MW (megawatts), which is around 25% of current peak electricity demand across New Zealand, could be shifted to off-peak. This corresponds to a total value of almost $3 billion of avoided investment in power generation and network infrastructure, using Transpower’s estimate of $1.5 billion cost reduction for each GW (gigawatt) peak demand is lowered.

- The model finds an additional ~500 MW of electricity use (for example industrial processes) could be curtailed (lowered) in return for the right incentives. However, curtailing electricity use is not required to get most of the benefits in the report.

- Approximately 1,350 GWh (gigawatt hours) of electricity use per year (roughly 3% of annual demand) could be shifted away from peaks at a procurement price (incentive payment) of less than $500/MWh. By 2040, this increases to almost 2,000 GWh. Although this is a small proportion of total electricity demand, it is significant in terms of peaking generation (for example, using gas peaking generators to provide enough power at times of heavy electricity demand).

- The modelling shows flexibility would be a cheaper option compared with upgrades across our lines networks and/or generating more electricity at peak times, although some upgrades and peaking generation would still be needed.

Pinpointing where the potential for flexibility lies

The research found that regionally, the residential sector offers the most potential for flexibility across the main centres because of its significant contribution to peak demand. Further to this, the large energy users in a residential setting (space and water heating and, increasingly, electric vehicle charging) are relatively simple to make flexible with smart controllers and have minimal impact on lifestyles.

Some regions and industries also stand out as also offering significant potential:

- Food processing in the Bay of Plenty, Waikato, and North Canterbury.

- Farming in Canterbury and Waikato, likely irrigation loads.

- Metal manufacturing in Southland and Auckland (such as NZ Aluminium Smelter and NZ Steel - noting that both have flexibility agreements in place).

- Forestry products in Bay of Plenty and Manawatū/Whanganui.

- Offices in the main centres.

These regional variations highlight the importance of tailoring solutions for local industry.

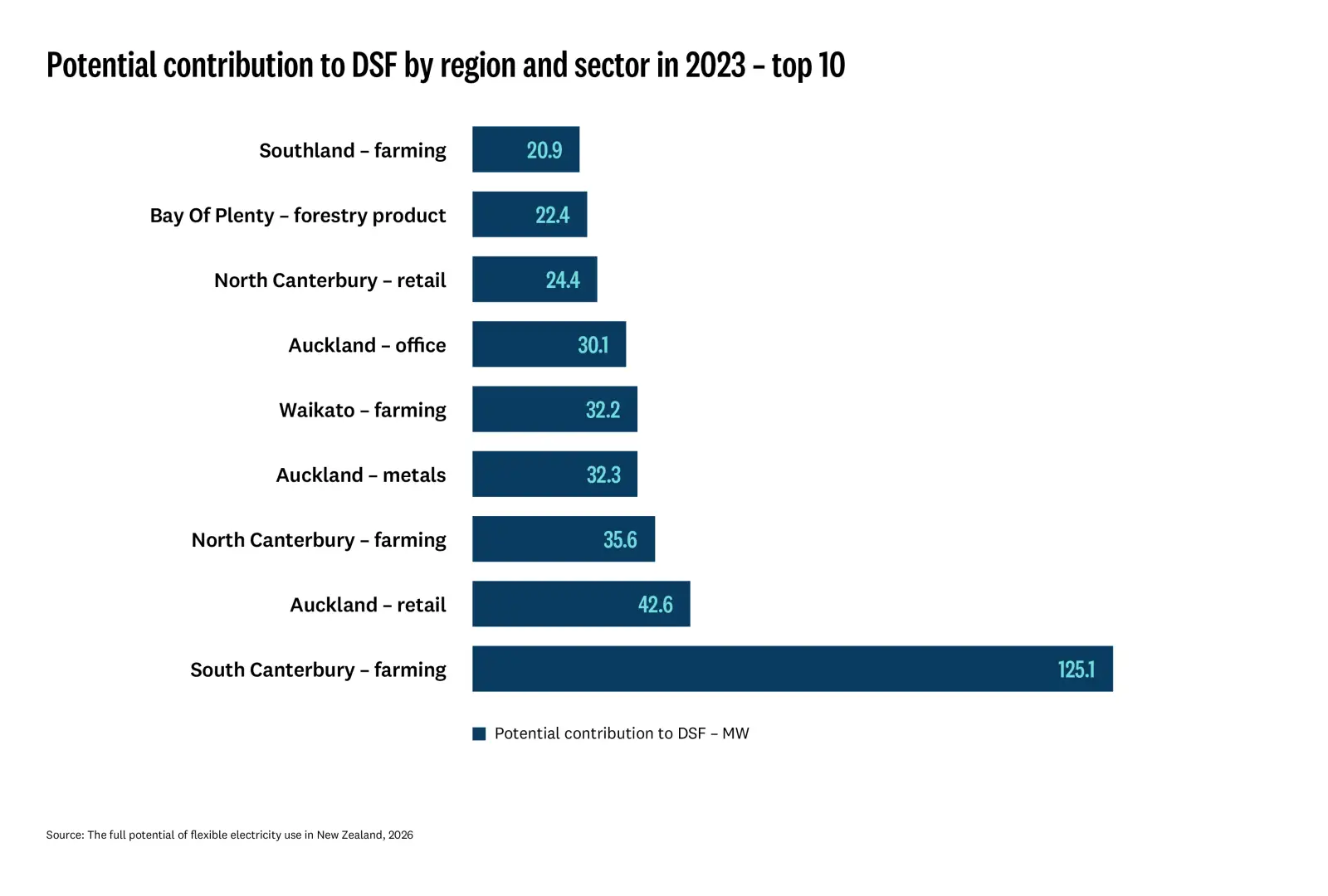

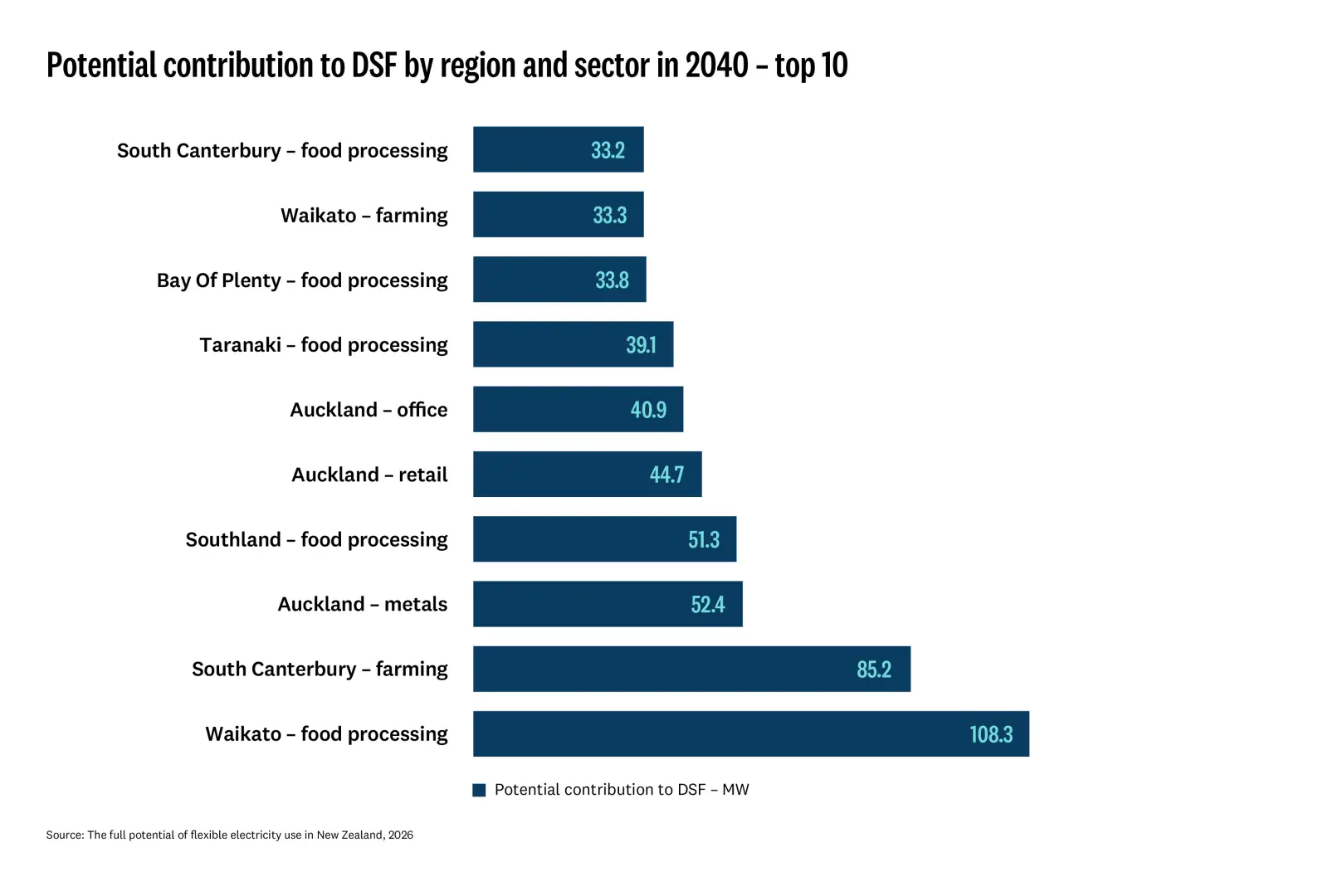

Top 10 potential contributors to flexibility: 2023 versus 2040

The graph below shows that, outside the residential sector in the main centres, the top 10 potential contributors to flexibility in a 2023 analysis were farming (particularly in South Canterbury), retail and offices in the large main centres, metals in Auckland, and forestry products in the Bay of Plenty.

By 2040 the electrification of process heat, particularly in food processing, pushes farming and commercial loads out of the top ten contributors in some regions and provides good flexible electricity use opportunities across Waikato, Southland, Taranaki, the Bay of Plenty, and Canterbury.

Industry attitudes towards flexible electricity use

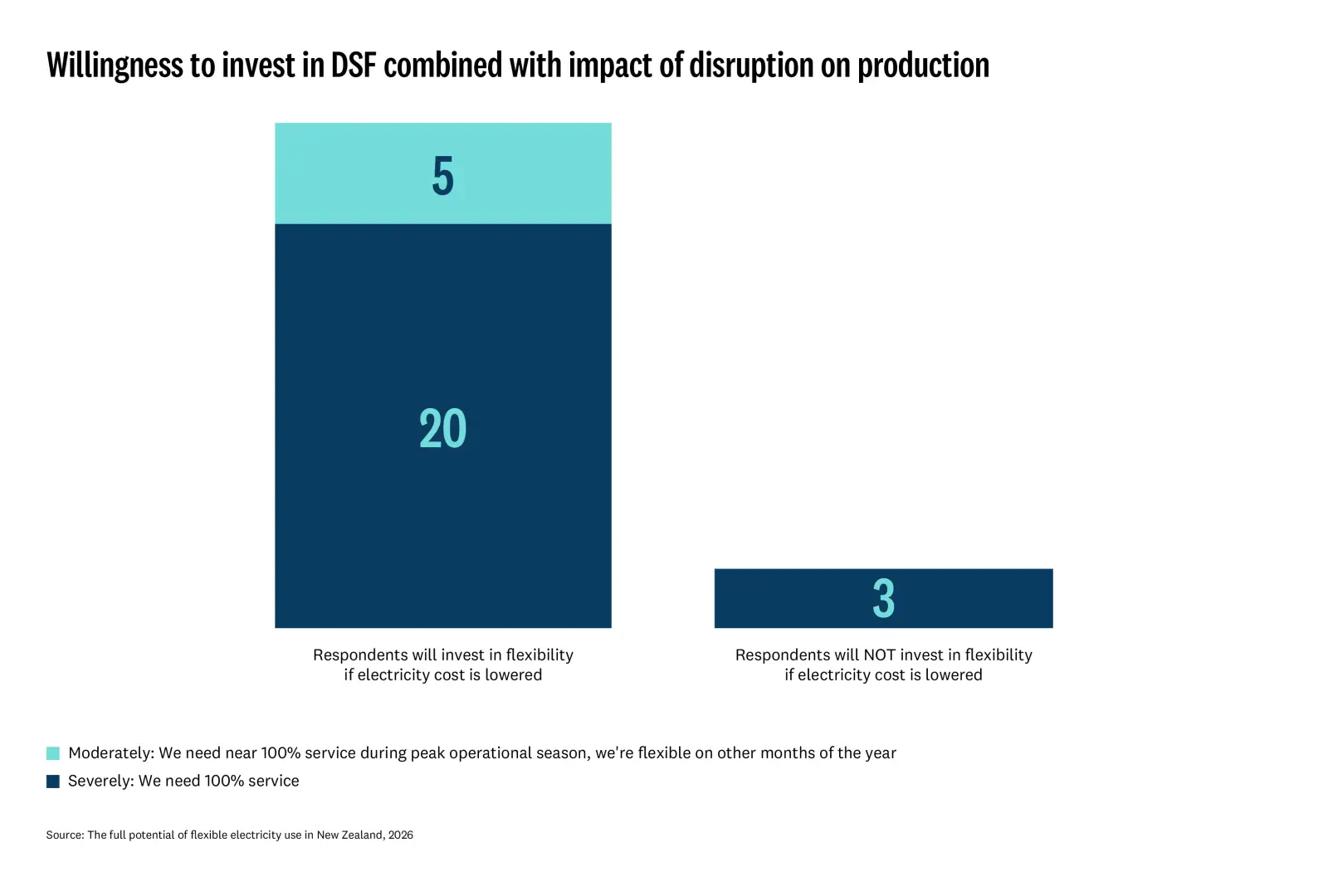

As part of the research, a survey of industrial electricity users revealed that production continuity is the top priority. However, many industrial electricity users were open to exploring flexible electricity use if it does not disrupt production and if the financial incentives are attractive.

Conclusions

The study highlights how important it is to better understand factors that might constrain flexibility, like people’s willingness to participate, costs of technologies, and the need for financial incentives to encourage people and businesses to take part.

The modelling reveals very significant potential for flexibility in New Zealand’s electricity market to contribute to more affordable, resilient and secure energy.

Realising this potential will require addressing behavioural, technological, regulatory, and market challenges.